039 - Brett Steenbarger - Mental Keys to Quantitative Trading Success

Trading in the Zone, Creativity, Open Mindedness

Hold up! Think quants don't need to know this stuff? Read on!

Psychology for Quant Traders? Really?

Quantitative futures traders like to think in code, not clichés—but Dr Brett Steenbarger makes a compelling case that mindset is part of the edge. In this interview, Brett argues that the same statistical rigor quants apply to markets should be applied to the grey matter behind the keyboard. Here's a guide for the advanced systematic trader who suspects “psy-stuff” might be more than motivational posters.

Born Vs. Made—The Talent + Skill Equation

I opened with the turtle-era debate: are great traders wired or trained? Brett’s answer is happily Bayesian. Yes, people arrive with innate “attentional talents” (think of the chess prodigy who can see five moves ahead), but sustainable P/L comes only after domain-specific skills are layered on top—just as a natural sprinter must still learn baton hand-offs to win a relay .

Practical take-away for futures quants:

1. Run a brutally honest post-mortem of which research tasks energize you—data-wrangling, model design, risk routing—and double down on those shards of talent.

2. Outsource or automate the chores that drain you; you can’t debug code while wishing you were exploring yield-curve regimes.

Different Brains, Different Horizons

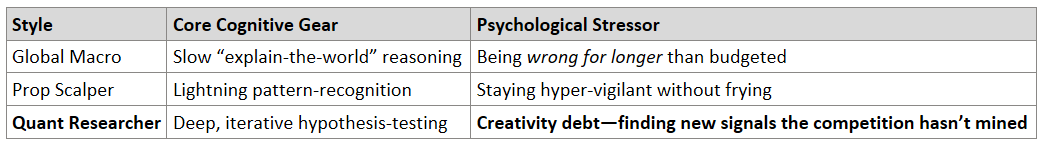

Brett contrasts three archetypes:

The quant generally sits in the 'slow thinking' space (a reference to Daniel Kahneman's book "Thinking, Fast and Slow"), taking time to generate ideas. However, in this big-picture context there can still be fast feedback loops once live trading, so it does pay to trade a style that will work for you once you go live. Knowing which stressor prowls your niche lets you build the right mental armor. Usually, it takes some exploration and experience to really hone in on what suits you.

Creativity: The Missing Factor in Sharpe Ratios

When “all you have is a hammer, everything looks like a nail,” Brett quips. Alpha today is less about raw processing power than seeing the familiar differently. His example is Marcos López de Prado’s use of event-time bars—each bar formed after a fixed number of contracts—not clock-time bars (tick charts?). That reframes the entire statistical structure of price series and reveals fresh cyclical signals.

Rapid-fire creativity drills for algo teams

• White-board mash-ups – every researcher posts their top 3 ideas; the room brainstorms what the world would look like if all 15 were simultaneously true.

• Cross-pollination meetings – pair the FX gal with the rates guy to hypothesize regime triggers that flip systems on/off.

• Daily “one weird plot” ritual – each coder brings a chart of something nobody tracks (distance-to-VWAP at settlement?) and defends why it might matter.

Creativity isn’t mystical; it’s a process measurable in research throughput.

On a more personal level, I know that my extreme businesses can stifle my creativity. It's usually on our day-off, sitting under an apple tree, that the big ideas come. Perhaps creativity married with statistical rigor and intellectual honesty (being honest about when you are over fitting, or have a less-than-scientific method) are the keys to systematic trading success.

Overfitting, Context, and Turning Systems Off

Brett skewers the rookie obsession with the “Holy Grail system.” Institutional PMs, he notes, expect to toggle models in and out according to market context—say, an FX-momentum strategy that only trades when the yield-curve shape matches historical trending regimes. Robustness lives in breadth of conditional edges, not a single swiss-army knife .

Some Robustness Checklist items from Brett:

• Walk-forward across non-overlapping regimes to be sure a single regime isn't carrying the stats.

• Test on sufficient data.

• Kick the tyres: nudge entry, exit and sizing rules, swap data frequency, even change the market. If P&L falls off a cliff, the edge wasn't real.

• Don't data mine; demand and economic or behavioural rationale first.

• Edges often appear only in specific volatility, liquidity or rate regimes; build regime filters and be willing to turn systems off.

• He points non-programmers to Trading Blox, Trade-Ideas Odds-Maker and Worden Blocks so nobody has an excuse to skip testing. Get Real Test and you can become a programmer really fast.

• Stress-test with randomized events.

• Try to break it. This is gold.

• Shadow-trade in sim until the gut agrees with the statistics; intuition is an overfitting early-warning system.

Yes, even quant trading is art and science. There's an art to using the science correctly.

Trading as a Competitive Performance Sport

“Markets are a competitive activity,” Brett reminds us. Like athletes, traders need deliberate practice and state-control. His latest fascination is neuro-feedback: using a Muse headband to train the brain into sustained alpha-wave focus. Birds chirp in the app when concentration deepens—gamified mindfulness for quants .

Older school? Bio-feedback via heart-rate variability works too . The goal isn’t Zen serenity but selective arousal—full engagement without cognitive noise. Concentrated brains look different to simply relaxed brains.

Solution-Focused Reviews: Fix What Works

Typical “trading psychology” harps on mistakes. Brett flips the script with solution-focused coaching: catalogue the successes where you didn’t overfit or where you executed perfectly, then reverse-engineer those conditions and ritualise them. Build on strengths rather than obsess over flaws .

Action step: After each strategy creation project say, jot two things you crushed and one micro-tweak. Over weeks the wins compound; the tweak list stays small and actionable. As systematic traders we could apply this discipline to any number of work projects, such as reviews of our processes for robustness testing, etc.

Team Dynamics & Guarding the IP

Elite quant pods marry diverse specialists—data engineer, statistician, market-structure geek, portfolio orchestrator. Sharing raw P/L drivers outside the pod is taboo, but sharing frameworks (e.g., NYSE uptick/downtick ratio as an institutional footprint proxy) is kosher and sparks reciprocal insight. Having a team of collaborators is a tried and true scientific model. Most great discoveries are a result of multiple minds working together, standing on the shoulders of giants. I'm looking forward to developing a community here at the Algo Advantage, stay tuned for that.

Solo futures traders can mimic the model:

• Team up with someone you find on a forum interested in tackling the same problems as you.

• Meet weekly to brainstorm while redacting proprietary parameters if need be.

• Seek out a mentor.

Mentoring, Simulation, and Managing Expectations

Whether at SMB Capital or multi-strategy hedge funds, newcomers face the same progression: sim → tiny real money → scalable book. The structure safeguards capital and compresses feedback cycles. Retail quants should copy the path—trade micros, not minis, until the Monte Carlo of live results matches the back-test confidence interval .

Oh, and You Wanted to Know about Brett's own Trading?

Brett’s own trading is a deliberately narrow, high-conviction affair. He trades the E-mini S&P and other index futures off three volume-based charts (small, medium and large bars that form after a fixed number of contracts, not after a fixed number of seconds) so the market “breathes” at its natural pace rather than the clock’s. Across all three he layers adaptive moving averages, a short-lookback RSI, a detrended oscillator and—most crucially—an order-flow delta pane that tracks volume lifting the offer versus hitting the bid; when heavy selling can’t push price lower, he stalks the inevitable squeeze. A 15-second NYSE TICK then fine-tunes entries, and position size is dialed up only when the signals line up across every frame. To keep the mind as disciplined as the stats, he allows himself one A-plus trade in the morning and one in the afternoon—sniper fire rather than machine-gun bursts—before resetting and journaling for the next “mini trading day.”

Closing Bell

The punch-line from Brett’s research is simple: systematic trading is less “set-and-forget” and more Formula 1 pit-crew—engineering precision plus real-time human performance. Code finds edges; psychology keeps you creative enough to refresh them. Or, as one of Brett’s blog posts puts it, “We can’t run robust systems from brittle minds.” Not a bad mantra to stick on your trading monitor!

So glad I took the opportunity to talk with Brett, I got way more out of it than expected. Thanks Brett!

Get in Touch with Brett: