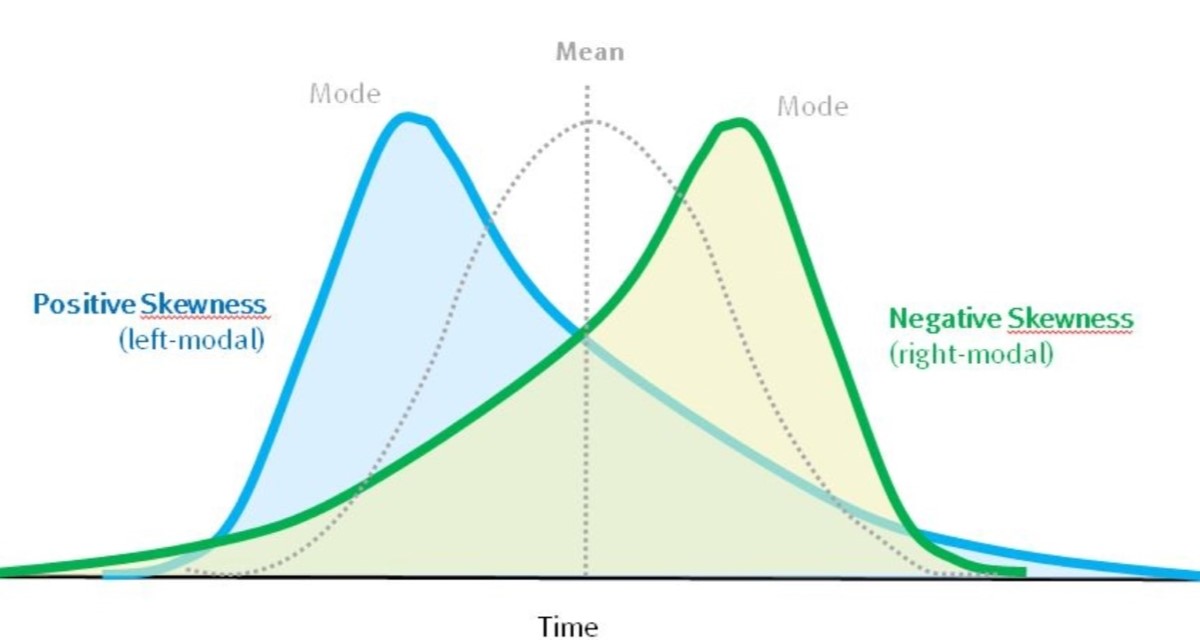

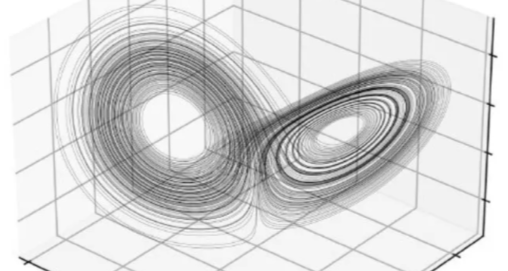

In the ever-evolving landscape of financial markets, the application of traditional statistical models, such as the Central Limit Theorem (CLT), often proves to be inadequate for capturing the complexities of complex adaptive systems (CAS). These systems, which are a hallmark of financial markets, defy the conventional assumptions of linearity, independence, identical distribution, and stationarity, which […]